Roku Stock Is Beaten Down Now, But It Could 10X

Few stocks fell as far in the 2022 tech stock crash as Roku (NASDAQ: ROKU).

From peak to trough, Roku stock fell more than 90% as stocks and industries that boomed during the pandemic crashed in the reopening. Streaming media was one of them. Streaming sign-ups at services such as Netflix (NASDAQ: NFLX) soared during the pandemic and then hit a wall in 2022, and Roku was a victim of that trend as well.

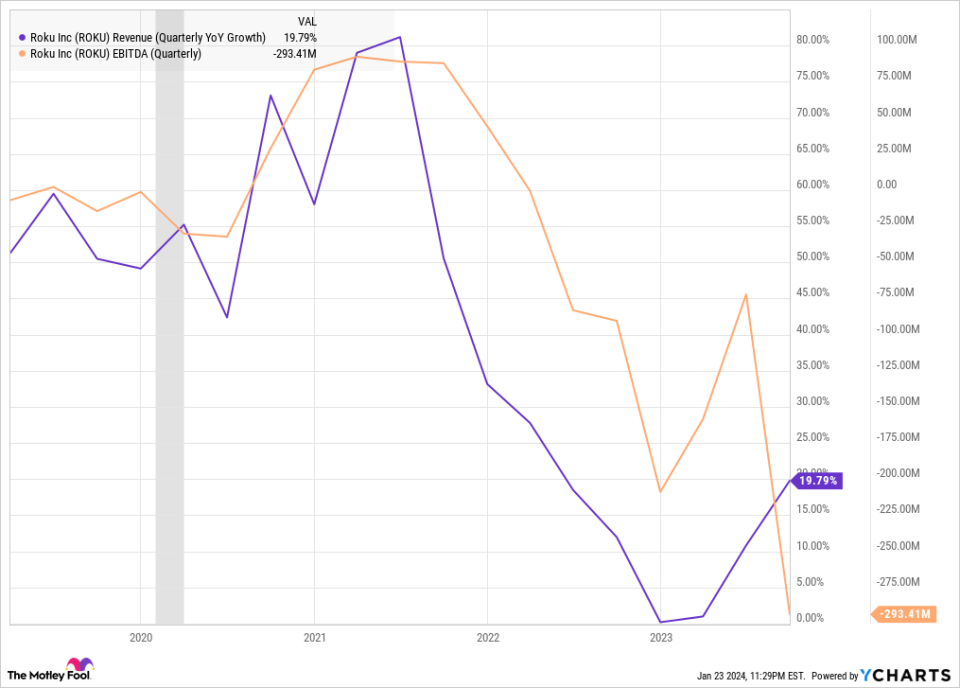

The company’s business is primarily driven by streaming growth and digital advertising, and both of those industries slowed sharply in 2022. At the same time, Roku had ramped up its spending, leading to wide losses. The following chart shows how the company’s revenue growth slumped and profits turned into losses during that period.

Revenue growth fell sharply in 2022 and essentially flatlined for two quarters in a row before a recent rebound. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) have followed a similar trajectory and were actually positive in the third quarter for the first time in several years, when costs related to layoffs are excluded.

The rebound is underway

Roku stock is still down roughly 80% from its pandemic-era peak, but the business is clearly moving in the right direction.

In its third quarter, the number of active accounts on the platform rose 16% to 75.8 million, and the number of streaming hours jumped 22% to 26.7 billion, showing that usage on the platform continues to grow steadily. Revenue growth also improved to 20%, its fastest pace in six quarters as advertising demand is recovering.

Roku has trimmed its cost structure after three rounds of layoffs, which has allowed it to return to positive adjusted EBITDA after several quarters of losses. in this metric. Roku reported adjusted EBITDA profit of $43 million in the third quarter on $912 million in revenue.

But there’s more than just the company’s own numbers and improving digital advertising demand that are driving the company’s recovery.

Ad-based streaming is finally going mainstream, now that major streamers Netflix, Disney, and Amazon are all embracing it. Consumers are hungry for this option, too. Netflix said in its fourth-quarter earnings report that the number of ad-based subscribers increased by 70% from the previous quarter and that 40% of new signups in markets where advertising is available chose the ad-based tier.

That’s good news for Roku, because the leading streaming platform generally takes 30% of advertising inventory from its streaming service partners. So the more ad-tier signups they get, the more money that should eventually flow to Roku.

Why Roku could 10x

It’s not easy for any stock to increase tenfold, but Roku has a chance to do it. The video entertainment market is massive; streaming still makes up less than half of video consumption in the U.S. and considerably less in other countries. Market share will continue to shift from linear TV to streaming.

The stock is also small and well-priced enough to give it room to appreciate by 10 times. First, its market cap is $13 billion, and reaching a market cap of $130 billion in the next decade wouldn’t seem unreasonable for the leading streaming distribution platform, especially if Roku can maintain its user growth rate.

The company isn’t currently profitable, but it trades at a price-to-sales ratio of under 4, which is modest enough to give the stock upside potential as well.

If Roku can grow its revenue by 20% over the next decade, which seems achievable given the shift from linear to streaming and the embrace of ad-based streaming, that would take its revenue up by close to seven times, from $3.45 billion to $21.4 billion. If its price-to-sales multiple expands to 6, which could easily happen as the business is likely to profitable by then, the stock price will have multiplied by 10 times. At a 10% profit margin, Roku’s stock would then trade at a price-to-earnings ratio of around 60 lofty but not unusual for a fast-growing market darling.

The opportunity is there if Roku executes. It will need to keep gaining new users, taking market share, and building ad inventory with the help of its streaming partners, but it looks like one of the best prospects for 10x growth over the next decade.

Should you invest $1,000 in Roku right now?

Before you buy stock in Roku, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Roku wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jeremy Bowman has positions in Amazon, Netflix, Roku, and Walt Disney. The Motley Fool has positions in and recommends Amazon, Netflix, Roku, and Walt Disney. The Motley Fool has a disclosure policy.

Roku Stock Is Beaten Down Now, But It Could 10X was originally published by The Motley Fool

Source link