The stock market is sending retirement account balances soaring. Here’s why experts say retirees still need to tread carefully.

-

Stellar stock-market returns have boosted Americans’ retirement account balances.

-

The number of 401(k) millionaires is up and average account balances are the highest in two years.

-

Sources caution anyone thinking about retirement not to get complacent and plan ahead if they want to tap their gains.

The soaring stock market is minting a lot of 401(k) millionaires.

Thanks to a stunning market rally since the beginning of 2023, the number of people with at least $1 million in their retirement account jumped 20% year-over-year in fourth quarter of 2023, with that average account balance rising to the highest level in two years, according to Fidelity.

While it may be tempting for bullish workers to start pulling money out to fund their post-employment lifestyles, or even start taking that money out ahead of retirement, investing experts warn against such considerations even as the market smashes records and optimism is high.

Here are a few things experts say people need to think about if the market’s stellar streak of gains may be tempting them to consider retiring or drawing on those funds early.

People are living longer

Brian Spinelli, the co-chief investment officer at wealth advisory firm Halbert Hargrove, told Business Insider that early retirement based on market performance is irrational simply because people are living longer these days.

“The number of years you’re gonna have to draw on your own money is now getting wider. So if you retire too early, you might run out of runway with your portfolio because you live longer than you thought,” he said.

Early retirees may underestimate the required funds for their desired lifestyle due to overlooking the simple fact that they could live longer than they expect, and untaxed 401(k) contributions may necessitate higher withdrawals to cover taxes.

“The biggest single risk we see is that most investors, without heavy education, underestimate their longevity, time horizon, and opportunity cost, increasing the risk of short-term loss while increasing the risk of late stage aged poverty,” Aaron Anderson, senior vice president of research at Fisher Investments, told Business Insider in an email.

“If they need $100,000 net, they’re going to have to withdraw $120,000 to $130,000 a year out of their million dollar 401(k) to cover the taxes and get them that $100,000,” Spinelli said, adding that with a 30-year life expectancy horizon, expecting consistent annual growth well beyond 12% or 13% without downturns is unrealistic.

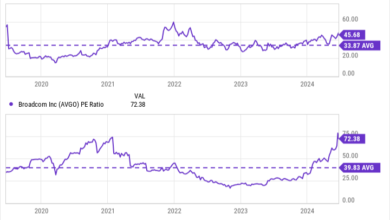

Markets are volatile

Investing experts also caution against the belief that the market will keep producing strong returns year after year. Stocks gained nearly 25% in 2023, but that’s an outlier and returns flatten out over time with the normal ups and downs to an annual average gain of just about 10% for the benchmark S&P 500.

“Stocks long-term average return is around 10% per year. However, that average is made up of yearly returns that vary widely. Markets are up big (+20%) or negative nearly two-thirds of the time whereas ‘average’ returns (0-20%) only happen about a third of the time,” Anderson wrote.

Future uncertainty often brings a “sequence of returns risk” that’s overlooked by early retirees.

“The difference between an investor that draws on their retirement funds early and one that leaves them to continue experiencing the benefits of compounding growth can be immense,” Anderson added.

Baby boomers looking to cash in on their gains could also trigger a sell-off, potentially dragging down the broader market. Some have argued that more older Americans owning stocks is risky, as they don’t have the luxury to wait out a downturn and could panic sell into a correction, fueling further declines.

Sources emphasized the need for retirees to conduct a “stress test” on their retirement plans, factoring in market corrections, life expectancy, inflation, asset drawdowns, and spending projections.

“Can you ride through this long enough for it to recover and still be able to not outlive your money? And if the answer’s no, maybe that involves working more time,” Spinelli said.

Read the original article on Business Insider

Source link